Introducing Blockchain Billing Service

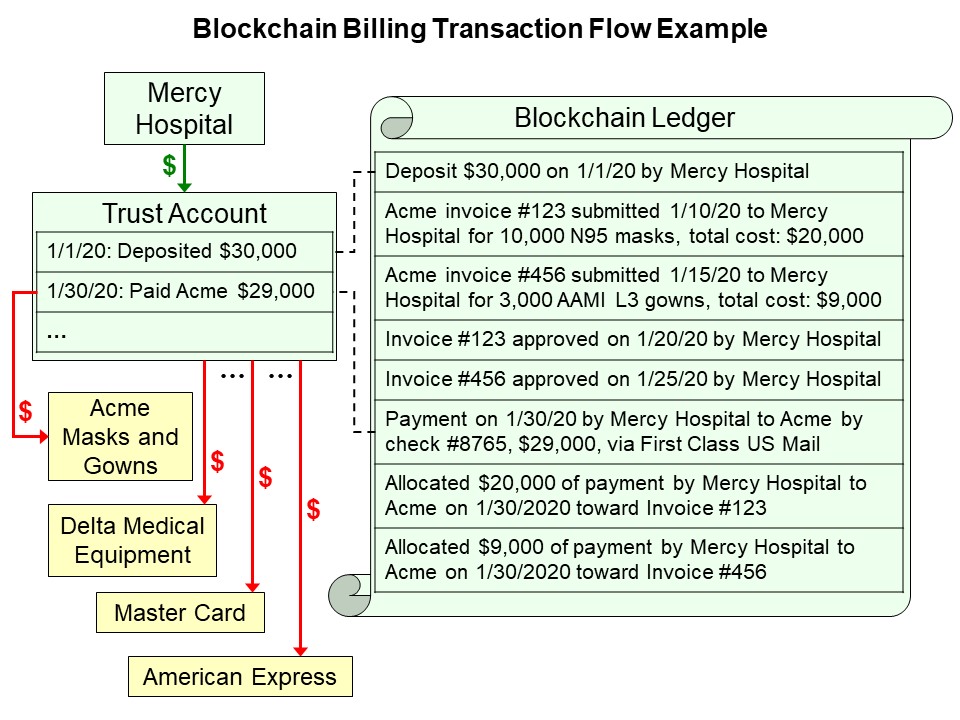

Content Galaxy's BBS (Blockchain Billing Service) provides a platform for trustworthy invoicing

and payment, where large amounts of money and many independent participants are involved.

The system leverages blockchain and database technologies to build verifiable, fraud-resistant services that automate complex

financial agreements.

We are road-testing it internally for our video streaming platform, and the plan is to release BBS as an open source project.

Using Blockchain to Reduce Financial Fraud

With the growth of e-commerce, we have become more vulnerable to spectacular failures of traditional financial safeguards, most recently and dramatically illustrated by FTX.

From a business standpoint, the maxim "trust but verify" really means trust as little as necessary and verify appropriately.

Content Galaxy's Blockchain Billing Service (BBS) reduces the necessity of trusting intermediaries and increases the efficiency of timely and thorough verification.

We can trust our own bank account when it is in a reputable bank, regulated and insured by the U.S. government.

We can also trust that a properly constructed blockchain ledger provides a strong assurance of integrity and verifiability.

Do we really need to trust anything else?

From the standpoint of convenience and economy, we find ourselves increasingly dependent on intermediaries - some more trustworthy than others.

By masquerading as a bank-like entity, FTX gained an undue amount of trust without providing a credible mechanism for verifying its reporting.

BBS could have reduced the necessity of trusting FTX and would have offered a rigorous and efficient guarantee of rapid auditability.

This would have made their fraud virtually impossible. The key to Content Galaxy’s approach is the uniquely efficient way it combines blockchain and database technology.

BBS can be integrated smoothly into an existing financial application, enhancing its reporting capabilities.

A serious problem with most attempts to incorporate blockchain into financial record keeping is that blockchain manipulations are relatively costly

and clumsy compared to the highly refined tools of established database management systems.

BBS avoids this problem by integrating blockchain in a minimalist way, without burdening an otherwise efficient database application.

For most banking, business, and securities applications, a small number of blockchain transactions at critical points can reliably document

and secure a much larger number of actual database calculations and transactions.

This more selective approach for using blockchain to achieve fraud resistance allows for the creation of distributed ledgers

that can detect tampering against the central database without a perceptible performance penalty.

Ultimately, BBS can reduce corporate financial fraud markedly.

The protection provided by this use of blockchain ledgers could benefit a wide variety of medium to large businesses, including investment firms,

software-as-a-service (SaaS) providers, e-commerce sites, joint-purchasing services, prime contractors, and government applications.

The blockchain ledger guarantees a credible audit trail.